ESOP Employee Stock Ownership Plans

(ESOP) Employee Stock Ownership Plan

and

Cashless Option Exercise Planning

and

Cashless Option Exercise Planning

One of the most rewarding benefits of working for a publicly traded company is when the employee is granted company stock options. Company stock options offer an employee a way to participate in the growth of his or her company. They are also one of the most confusing and least understood among company benefits.

An Employee Stock Ownership Plan (ESOP) or Incentive Stock Option (ISO) are types of plans that either grant or enables employees to invest primarily in employer listed stock. On occasion employees risk accumulating too much of their personal assets into their employer’s company listed stock. This usually results in an extremely undiversified portfolio. In certain circumstances the company listed stock may be doing well and the employee may not want to sell it to diversify. At other times the Company may experience financial trouble and, in addition to a probable lay-off, the company stock value may drop just when you need it the most.

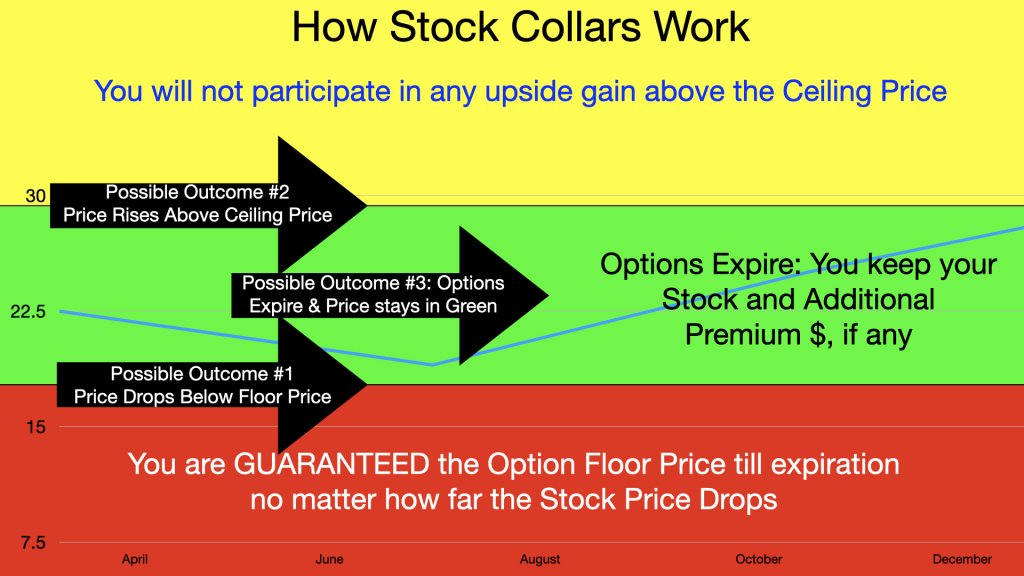

Through the strategic use of an "Option Collar", a simultaneously written call option and the purchase of a protective put option, EB Financial Planning can construct a floor and a ceiling on the price of a listed stock. This will “Collar” the stock price into one of three PREDICTABLE Outcomes for a period of time. This will provide price predictability during the option holding period, for your peace of mind. Only one of three possible outcomes will occur, provided the securities are held until the options expire:

POSSIBLE OUTCOME # 1 - Listed stock price drops

below the "floor" price.

In the event that the stock price falls below the strike price of the protective put, the employee may exercise the right to put (SELL) the stock at the floor price regardless of how low the price falls, even if it falls to ZERO!

POSSIBLE OUTCOME # 2 - Listed stock rises above the

"ceiling" price.

In the event that the stock price rises above the strike price of the covered call, the employee will be obligated to sell the stock at the ceiling strike price regardless of how high the price rises. Thereby limiting the maximum gain to the Call strike price, which will be higher than your purchase paid.

POSSIBLE OUTCOME #3 - The listed stock price stays between the "floor" and "ceiling" price until the option expire.

Employee gets to keep the listed company stock plus any premiums received from the sale of the call, if any. Employee can then decide whether to sell the stock to diversify or do another collar in order to extend the holding period and possibly receive additional income.

Hypothetical Option Collar Illustration

Cashless Listed Stock Option Transactions

When your options are exercised taxes may be due IMMEDIATELY upon excising of an option. This can result in a large amount of shares having to be sold in order to pay Uncle Sam. Instead of selling margin-able securities to cover taxes, margin-able Securities may be held in a Margin Account. Tax bills may be settled with the use of a Margin Loan against the value of the margin-able Securities. Thereby the Employee can hold the maximum amount of shares. Consideration must also be given to which options to exercise, as well as when to sell the shares.

Please let us know via the Inquiry/Contact Us link how we can be of assistance. Together we can tailor a plan that will enable you to hold excessive Employer Stock shares and limit your downside risk.

Non-Collared listed options and margin accounts may not be appropriate for all investors.

Since option strategies involve unique risk considerations such as tax consequences and commission charges, among other factors. Non-collared listed options are not suitable for all investors. When appropriate, options should only comprise a modest portion of your portfolio. Prior to making any options transactions, investors must receive a copy of Options Disclosure Document, which may be obtained by clicking here. Margin accounts may not be appropriate for all investors. Clients should be aware that sometimes you can lose more funds than you deposit in a margin account. A broker/dealer can force the sale of securities in your account, without contacting you and you will have no say in which securities are sold. A broker/dealer can increase the house maintenance requirements on your position without advance notice. You are not entitled to an extension of time on a margin call. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Planners & Investment Advisors of EB Financial Planning, we are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with your appropriate tax or legal professional. The investment return and principal value of an investment security will fluctuate with market conditions so that when redeemed the value of the investment may be worth more or less than the original cost.